All Categories

Featured

If you're going to use a small-cap index like the Russell 2000, you might wish to stop and consider why a good index fund company, like Lead, does not have any funds that follow it. The reason is since it's a lousy index. Not to mention that changing your whole plan from one index to an additional is barely what I would call "rebalancing - compare universal life insurance rates." Cash value life insurance coverage isn't an appealing property course.

I have not even resolved the straw male below yet, which is the reality that it is reasonably rare that you really need to pay either taxes or substantial compensations to rebalance anyway. I never ever have. Most smart investors rebalance as long as possible in their tax-protected accounts. If that isn't rather sufficient, early collectors can rebalance purely using new contributions.

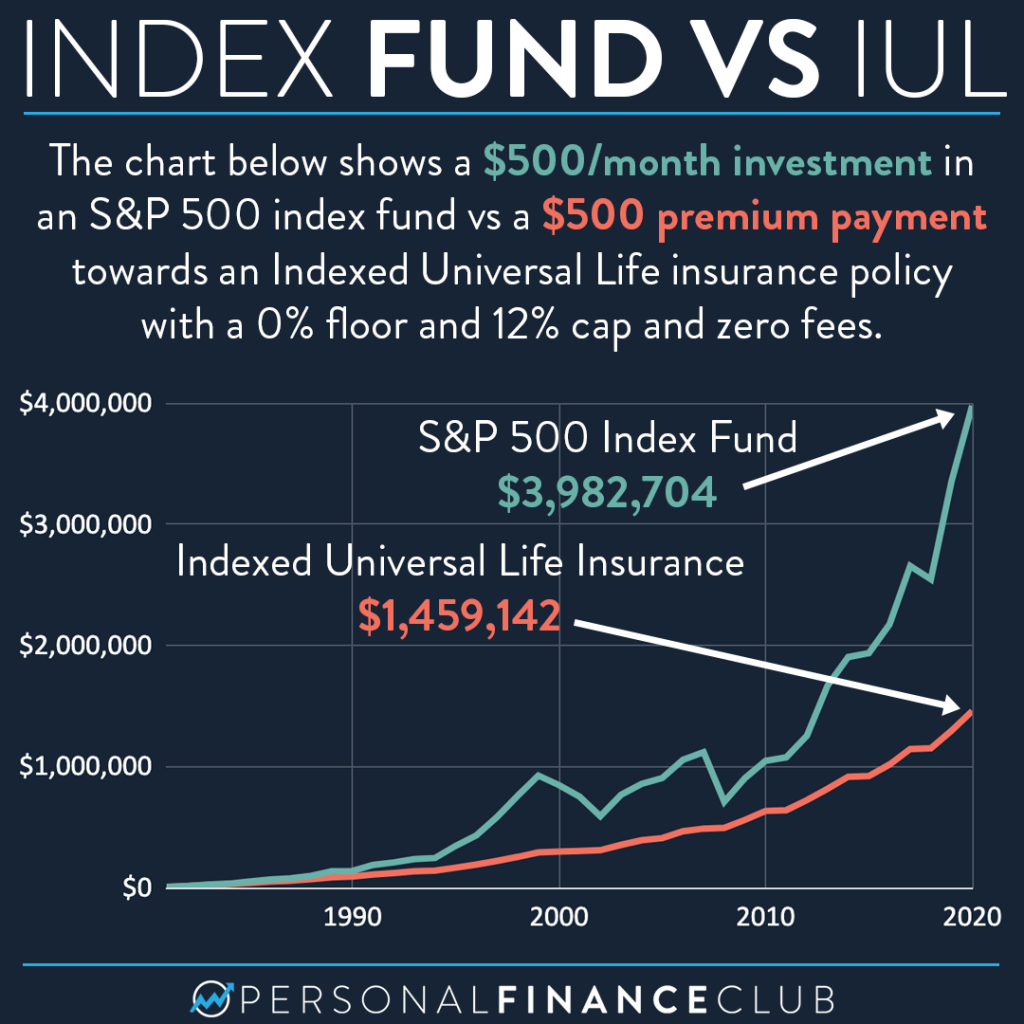

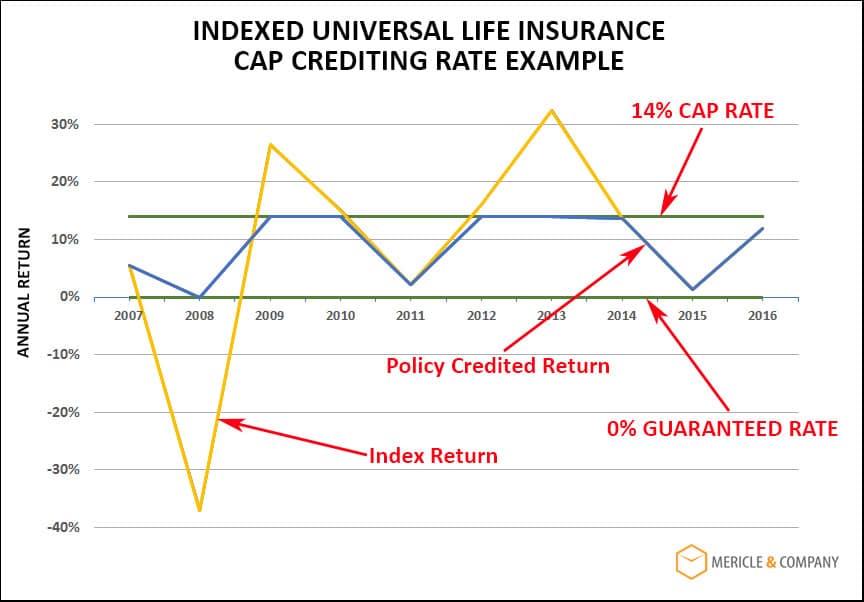

Is Indexed Universal Life A Good Investment

And of program, no one needs to be purchasing loaded common funds, ever. It's really also negative that IULs don't function.

Latest Posts

History Of Universal Life Insurance

Universal Life Insurance With Living Benefits

Accumulation At Interest Option